An Arizona Public School Tax Credit Donation is a Win-Win for Khalsa Students and You!

Through the Arizona Public School Tax Credit program (ARS 43-1089.01), taxpayers can donate to the Khalsa Activity Fund and help support extracurricular activities and receive every dollar back in the form of a tax credit. Taxpayers can contribute up to $400 for married couples or $200 for individuals.

The AZ Public School Tax Credit is an excellent way to support Khalsa without costing anything to yourself. Rather than allowing your tax dollars to go to the general fund, you can direct those dollars to a cause you care about – your student’s education!

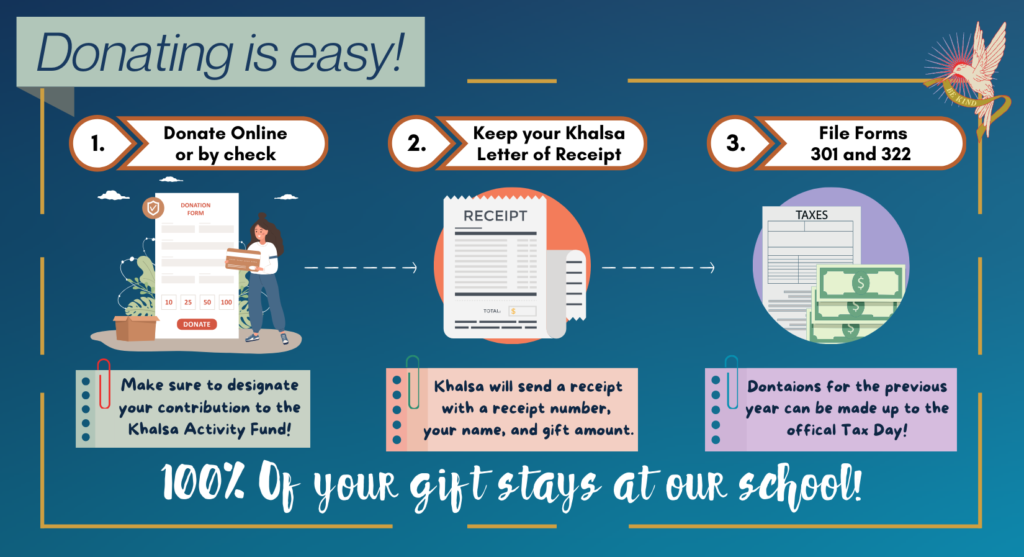

How Do I Donate?

- Donate Online (Make sure you designate your contribution to the Khalsa Activity Fund.)

- Personal Check made payable to “Khalsa Montessori Elementary School” along with your completed Activity Fund gift form.

- Mail your check to:

Khalsa Montessori School

2536 N. 3rd St.

Phoenix, AZ 85004

- Mail your check to:

After we receive your generous gift, the school will send you a receipt letter with a reciept number, your name, and gift amount.

How will your gift be used?

The donated funds will be spent to expand special learning education activities for Khalsa Montessori School children. In the past years, the Khalsa Montessori Activity Fund has been used to continue enriching student learning through all of our special character education programs like gardening, yoga, Spanish, and monthly field trips connected to curriculum studies. These programs allow students to apply character traits of responsibility, compassion, attentiveness, truthfulness, respect, diligence, sincerity, and virtue. Students showcase their talents at the annual holiday program performances. Donations also enabled us to offer more activity fee discounts to the growing number of families who needed this assistance.

Tax Credit FAQs:

Q. Which Tax Forms Do I Use?

- State – File Form 301 and Form 322 with your Arizona State income tax return to report your donation and receive your credit.

- Federal – Include your contribution on your itemized charitable contributions deductions to decrease your Federal tax liability.

Q. Can my friends and family make a school tax-credit contribution to Khalsa Montessori Charter School?

A. Yes, anyone who pays taxes to the State of Arizona can take full advantage of the school tax credit to the school of their choice!

Q: If I make a school tax-credit contribution, will it affect other tax-credit contributions I make?

A: Contributing to public and charter schools through this tax-credit does not affect other tax-credits such as credits for contributing to private schools or organizations that serve the working poor.

Q: Are there additional costs to me or fees associated with the school tax-credit?

A. Nope!

Q: Is there a minimum State income liability applicable?

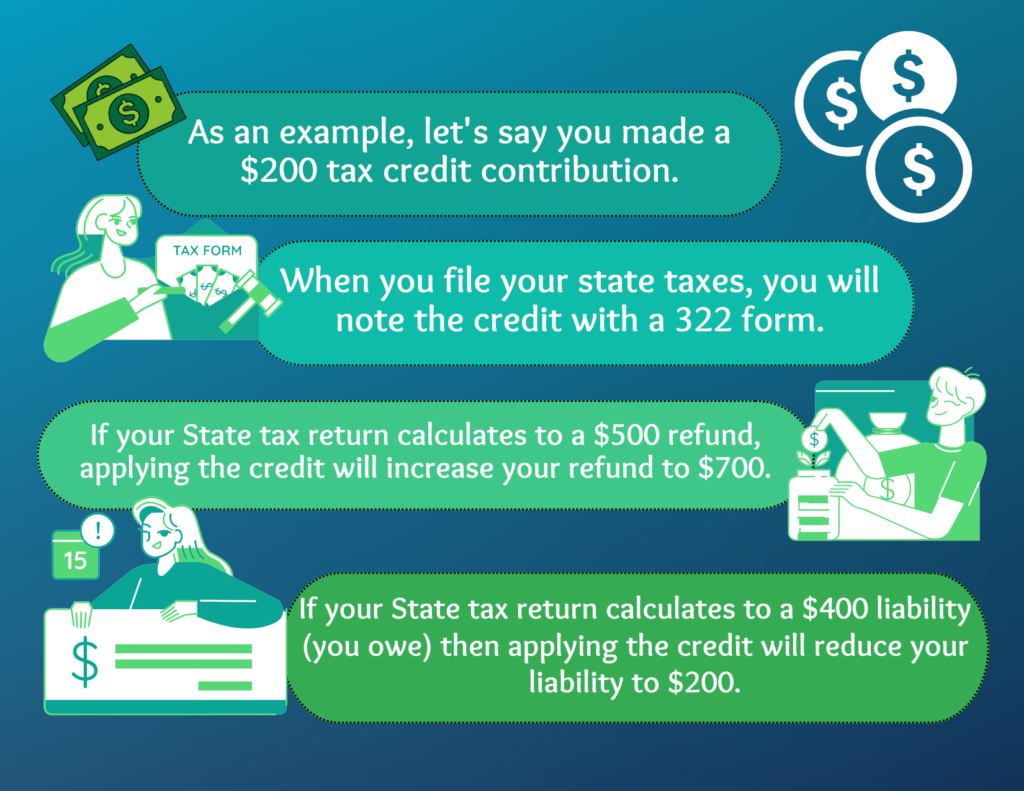

A: Your minimum State income liability must be greater than your tax credit contribution to receive a credit.

Q: What if I owe the State of Arizona?

A: For example: If you and your spouse have a remaining State liability of $1,000 and you donate a $400 school tax-credit, together you can immediately reduce that balance in liability to $600.

Q: What if the State of Arizona owes me?

A: For example: If the State owes you a refund of $500 and you donate a $200 tax-credit, you can increase your refund to $700.